The property tax breaks across England, Wales and Scotland is great news for both buyers and vendors – Guild Members are already reporting a surge in interest. The Guild supports Members with the tools and services that can help maximise the benefits of this Stamp Duty tax break – here are a few of the ways we can help you.

SDLT, LTT & LBTT HOLIDAY

HOW WILL YOU MAXIMISE THE PROPERTY TAX RELIEF IN YOUR AREA?

Rightmove are reporting a 46% surge in enquiries for homes priced between £400,000 and £500,000 following the Government's SDLT and LBTT relief announcement – how will you make the most of the latest COVID-19 relief strategy?

Online Calculators

The Guild has a bespoke calculator on its website which is also available on any website templates we build and host for our Members. Our calculator can help buyers across England, Scotland and Wales to calculate the SDLT, LTT or LBTT payable on any property they're looking to purchase and it's a great resource to promote digitally.

Social Media Marketing Materials

Members have access to a variety of free marketing materials designed for social media which can help to build engagement across their channels and help them to gain new business. We have assets for England, Scotland and Wales.

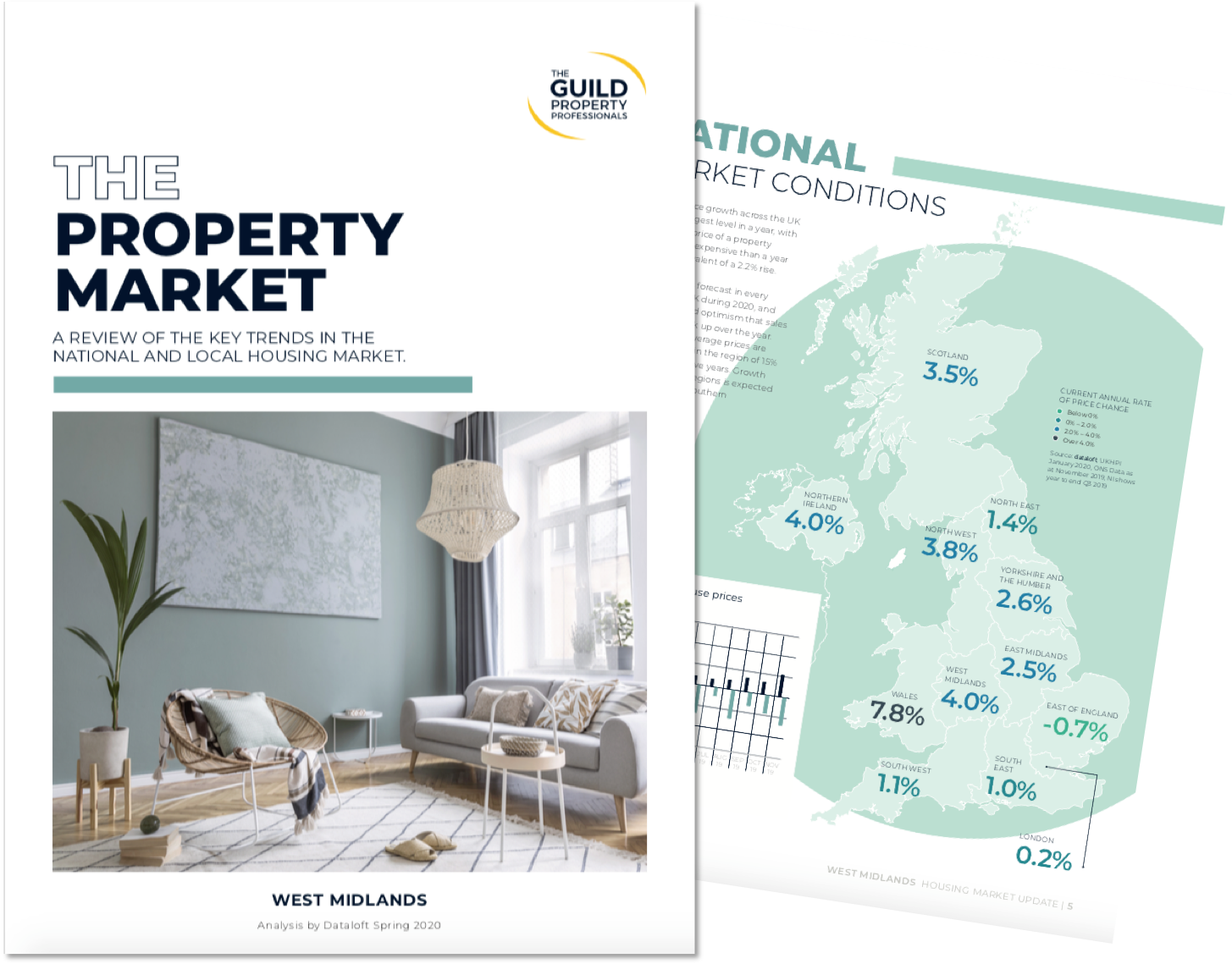

Regional Market Reports

Members have access to quarterly market reports, which include average regional house prices, so Members can show potential vendors or buyers just how much they could save in your specific area.

Industry Comment on Stamp Duty

Iain McKenzie, CEO of The Guild of Property Professionals, comments on how this will impact the property market:

"We welcome the changes to the SDLT. The government has used this incentive in the past to stimulate activity, as they know that it has a wider impact on the whole economy. Now, however, it is time for lenders to follow the lead and show the confidence that the market deserves by higher lending multiples for first and second-time buyers. It is vital that the incentive is not wasted by lenders not capitalising on the demand from buyers. Based on the volumes of activity in the market, there is currently an appetite to move. However, many will still struggle to get onto the ladder due to not being able to meet the deposit requirements.

"We welcome the changes to the SDLT. The government has used this incentive in the past to stimulate activity, as they know that it has a wider impact on the whole economy. Now, however, it is time for lenders to follow the lead and show the confidence that the market deserves by higher lending multiples for first and second-time buyers. It is vital that the incentive is not wasted by lenders not capitalising on the demand from buyers. Based on the volumes of activity in the market, there is currently an appetite to move. However, many will still struggle to get onto the ladder due to not being able to meet the deposit requirements.

At the moment, lenders are being more cautious as a result of the uncertainty with regards to pricing and the rise in unemployment. As a result, the number of high loan-to-value (LTV) mortgages available are still well below levels we saw before COVID-19 reached our shores, which will have the largest impact on first-time buyers. Towards the end of June, there were approximately 14 products offering a 95% LTV, with the majority of the remaining products offering 90% or less. That means that, based on the UK’s average price paid of £283,875, on a 90% LTV mortgage a first-time buyer would require a 10% deposit of £28,387 in addition to the money they would require for the associated fees of purchasing a property.

On the other side of the transaction, our advice now is for sellers to instruct a conveyancer at the time of first going to the market, to prepare a sale-ready pack. Conveyancers may get inundated with cases and best practice will try to avoid a blockage where possible."